10 Key Benefits of Intelligent Document Processing

As much as 80% of corporate data is unstructured. How can you take control of...

Our platform is used by companies in a variety of sectors, from finance to manufacturing

Thousands of customers streamline business processes and automate work with us

We offer a range of modules with different functionalities for each department of your company

PLUS WORKFLOW

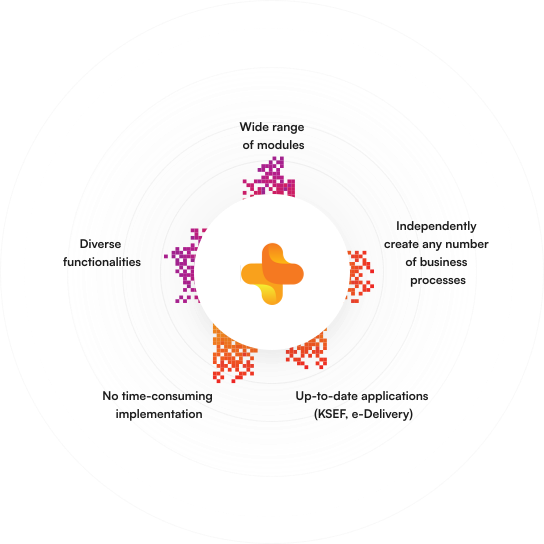

Plus Workflow is the leading low-code platform on the Polish market for automating business processes in the entire organization. With a wide range of modules with various functionalities, you can streamline work in every department of your company. From HR to finance, sales, IT, operations and much more. You have online access to a multitude of tasks in one place, and most importantly, you can create processes yourself without coding or programming knowledge. With an infinite number of processes, the possibilities that Plus Workflow provides are immense.

BENEFITS FOR YOUR COMPANY

This is a modern and comprehensive BPM solution for business process and document management. Plus Workflow supports electronic document workflow, enables scanning and OCR. It also allows designing new business processes, using Plus Workflow Editor, creating e-documents and archiving content. The main goal of the system is to reduce costs and optimize business processes.

Ready-to-implement business applications. A variety of functionalities for each department in the organization according to needs

You centralize all tasks and documents in one place, minimizing the number of lost documents

Plus Workflow allows you to speed up your work up to 60%. See our case studies of how we facilitate everyday work in thousands of companies

Electronic circulation of invoices and other documents significantly reduces the time of their flow, reducing operating costs

Plus Workflow Editor is self-creation and modification of processes without programmers, without cost, without waiting

Secure and legal. Get all the paperwork done in just a few clicks in our system

PLUS WORKFLOW

Plus Workflow is a modern tool for automating business processes, which supports efficient document management and optimization of key activities in the company. The system’s wide range of functionalities significantly improves the efficiency of your organization – you save time, minimize the risk of errors and increase your competitiveness in the market.

Our workflow and process management platform improves the efficiency of operations by reducing costs and accelerating processing times. Digitizing processes with Plus Workflow streamlines workflows, eliminates errors, automates operations, and enables tasks to be completed regardless of location.

For years, we have been implementing Plus Workflow for document workflow for clients in various industries, regardless of the size of the enterprise. We offer them customized solutions to meet their needs.

Plus Workflow allows you to model, modify and run new workflows and business processes/applications on your own without programming knowledge.

Thanks to the Plus Workflow platform, you can use ready-to-use business modules dedicated to each department in your company. From finance, accounting, administration to production, transport and logistics. You can also create processes on your own, according to the needs of a specific department. Plus Workflow is equipped with a number of modules, thanks to which working with the system is easy and pleasant, and the costs of implemented processes are lower.

Plus Workflow is a solution that allows the management of business processes and, consequently all the documentation in the company – both in terms of electronic document workflow, scanning, and electronic archiving. Plus Workflow is a server-based system, which users access from a web browser. Moreover, it is a solution that allows quick, easy, pleasant and fully independent start-up of subsequent processes and document workflows, without the need for programming knowledge or involvement of IT specialists.

For more than 20 years we have been implementing electronic document workflow in medium and large companies, which allows you to effectively control the circulation of documents in your company – from invoices to contracts, complaints and much more. The system is implemented instantly, without time-consuming processes and involving the IT department. Plus Workflow allows the digitalization of entire processes: from registering a document, through its description and approval, to its archiving.

Easy to use editor. You create processes by drag & drop

Ready-to-use business modules with a variety of functionalities

You create processes and navigate the system yourself. You don’t need to involve programmers

Wherever you are, your tasks and processes are under your control. The platform streamlines remote work

You get access to rich analytical tools. You generate reports, diagrams and more

Ability to integrate with any ERP and CRM system. Plus Workflow flexibly adapts to your daily operations

You reduce the time-consuming processes in your organization and the associated operating costs

By implementing an electronic workflow, including invoices, you don’t have to print hundreds of pages. You can access everything online

VIEW OUR CASE STUDIES

CONTACT OUR CONSULTANTS BY COMPLETING THE FORM